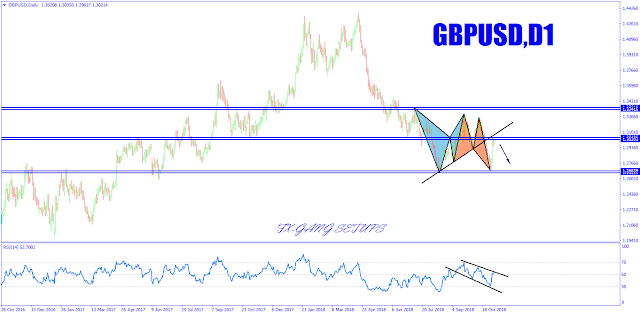

BIAS: BEARISH

THIS BLOG IS A HOME FOR EVERY FOREX TRADER IRRESPECTIVE OF WHETHER YOU ARE A NEWBIE OR A PRO TRADER ANYONE CAN LEARN SOMETHING FROM THIS BLOG LIKE SIMPLE REQUIREMENTS FOR A SUCCESSFUL TRADE & TECHNIQUES ON HOW TO CUT LOSES. FX-GANG OFFERS TECHNICAL ANALYSIS, FUNDAMENTAL ANALYSIS, SWING TRADING SIGNALS, TIPS & TRADING ARTICLES ON FOREX TRADING AND CRYPTO CURRENCY

Thursday, December 27, 2018

Wednesday, December 19, 2018

Tuesday, December 18, 2018

BITCOIN ANALYSIS 18TH DECECEMBER 2018

Bitcoin has been quite impulsive with the recent bullish momentum, leading the price towards $3,500-600 area. The price is currently residing inside the resistance area of $3,500-600 area from where it is expected to push higher towards $4,000 in the coming days if it manages to break above $3,600 area with a daily close. As the price remains above $3,000 area, the bullish pressure is expected to continue. Moreover, a daily close above $3,600 is expected to lead the price towards $4,000 area in the future.

SUPPORT: 3,000, 3,350, 3,500

RESISTANCE: 3,600, 4,000

BIAS: BULLISH

MOMENTUM: VOLATILE but IMPULSIVE

Monday, November 5, 2018

Wednesday, October 24, 2018

Monday, October 8, 2018

10 STEPS TO BUILDING A WINNING TRADING PLAN

There is an old saying in business: "Fail to plan and you plan to fail." It may sound glib, but those who are serious about being successful, including traders, should follow these eight words as if they were written in stone. Ask any trader who makes money on a consistent basis and they will tell you, "You have two choices: You can either methodically follow a written plan, or fail."

If you have a written trading or investment plan, congratulations! You are in the minority. While it is still no absolute guarantee of success, you have eliminated one major roadblock. If your plan uses flawed techniques or lacks preparation, your success won't come immediately, but at least you are in a position to chart and modify your course. By documenting the process, you learn what works and how to avoid repeating costly mistakes.

Whether or not you have a plan now, here are some ideas to help with the process.

Disaster Avoidance 101

Trading is a business, so you have to treat it as such if you want to succeed. Reading some books, buying a charting program, opening a brokerage account and starting to trade is not a business plan - it is a recipe for disaster. (For more, see Investing 101.)

Once a trader knows where the market has the potential to pause or reverse, they must then determine which one it will be and act accordingly. A plan should be written in stone while you are trading, but subject to re-evaluation once the market has closed. It changes with market conditions and adjusts as the trader's skill level improves. Each trader should write their own plan, taking into account personal trading styles and goals. Using someone else's plan does not reflect your trading characteristics.

Building the Perfect Master Plan

What are the components of a good trading plan? Here are 10 essentials that every plan should include:

1. Skill Assessment

Are you ready to trade? Have you tested your system by paper trading it, and do you have confidence that it works? Can you follow your signals without hesitation? Trading in the markets is a battle of give and take. The real pros are prepared and they take their profits from the rest of the crowd who, lacking a plan, give their money away through costly mistakes.

2. Mental Preparation

How do you feel? Did you get a good night's sleep? Do you feel up to the challenge ahead? If you are not emotionally and psychologically ready to do battle in the markets, it is better to take the day off – otherwise, you risk losing your shirt. This is guaranteed to happen if you are angry, preoccupied or otherwise distracted from the task at hand. Many traders have a market mantra they repeat before the day begins to get them ready. Create one that puts you in the trading zone. Additionally, your trading area should be free of distractions. Remember, this is a business, and distractions can be costly.

3. Set Risk Level

How much of your portfolio should you risk on any one trade? This will depend on your trading style and risk tolerance. It can range anywhere from around 1% to as much as 5% of your portfolio on a given trading day. That means if you lose that amount at any point in the day, you get out and stay out. It's better to keep powder dry to fight another day if things aren't going your way. (For more, read "What Is Your Risk Tolerance?")

4. Set Goals

Before you enter a trade, set realistic profit targets and risk/reward ratios. What is the minimum risk/reward you will accept? Many traders will not take a trade unless the potential profit is at least three times greater than the risk. For example, if your stop loss is a dollar loss per share, your goal should be a $3 profit. Set weekly, monthly and annual profit goals in dollars or as a percentage of your portfolio, and re-assess them regularly. (For more, see "Calculating Risk and Reward.")

5. Do Your Homework

Before the market opens, check what is going on around the world? Are overseas markets up or down? Are index futures such as the S&P 500 or Nasdaq 100 exchange-traded funds up or down in pre-market? Index futures are a good way of gauging market mood before the market opens.

What economic or earnings data is due out and when? Post a list on the wall in front of you and decide whether you want to trade ahead of an important report. For most traders, it is better to wait until the report is released than take unnecessary risk. Pros trade based on probabilities. They don't gamble.

6. Trade Preparation

Whatever trading system and program you use, label major and minor support and resistance levels, set alerts for entry and exit signals and make sure all signals can be easily seen or detected with a clear visual or auditory signal.

7. Set Exit Rules

Most traders make the mistake of concentrating 90% or more of their efforts in looking for buy signals, but pay very little attention to when and where to exit. Many traders cannot sell if they are down because they don't want to take a loss. Get over it or you will not make it as a trader. If your stop gets hit, it means you were wrong. Don't take it personally. Professional traders lose more trades than they win, but by managing money and limiting losses, they still end up making profits.

Before you enter a trade, you should know where your exits are. There are at least two for every trade. First, what is your stop loss if the trade goes against you? It must be written down. Mental stops don't count. Second, each trade should have a profit target. Once you get there, sell a portion of your position and you can move your stop loss on the rest of your position to breakeven if you wish. As discussed above, never risk more than a set percentage of your portfolio on any trade.

8. Set Entry Rules

This comes after the tips for exit rules for a reason: Exits are far more important than entries. A typical entry rule could be worded like this: "If signal A fires and there is a minimum target at least three times as great as my stop loss and we are at support, then buy X contracts or shares here."

Your system should be complicated enough to be effective, but simple enough to facilitate snap decisions. If you have 20 conditions that must be met and many are subjective, you will find it difficult if not impossible to actually make trades. Computers often make better traders than people, which may explain why nearly 50% of all trades that now occur on the New York Stock Exchange are computer-program generated.

Computers don't have to think or feel good to make a trade. If conditions are met, they enter. When the trade goes the wrong way or hits a profit target, they exit. They don't get angry at the market or feel invincible after making a few good trades. Each decision is based on probabilities. (For more, read: "The NYSE and Nasdaq: How They Work.")

9. Keep Excellent Records

All good traders are also good record keepers. If they win a trade, they want to know exactly why and how. More importantly, they want to know the same when they lose, so they don't repeat unnecessary mistakes. Write down details such as targets, the entry and exit of each trade, the time, support and resistance levels, daily opening range, market open and close for the day, and record comments about why you made the trade and lessons learned.

Also, you should save your trading records so that you can go back and analyze the profit or loss for a particular system, drawdowns (which are amounts lost per trade using a trading system), average time per trade (which is necessary to calculate trade efficiency) and other important factors, and also compare them to a buy-and-hold strategy. Remember, this is a business and you are the accountant.

10. Perform a Post-Mortem

After each trading day, adding up the profit or loss is secondary to knowing the why and how. Write down your conclusions in your trading journal so you can reference them later.

The Bottom Line

Successful paper trading does not guarantee you will have success when you begin trading real money and emotions come into play. But successful paper trading does give the trader confidence the system they are going to use actually works. Deciding on a system is less important than gaining enough skill to make trades without second guessing or doubting the decision.

There is no way to guarantee a trade will make money. The trader's chances are based on their skill and system of winning and losing. There is no such thing as winning without losing. Professional traders know before they enter a trade that the odds are in their favor or they wouldn't be there. By letting their profits ride and cutting losses short, a trader may lose some battles, but they will win the war. Most traders and investors do the opposite, which is why they never make money.

Traders who win consistently treat trading as a business. While it's not a guarantee that you will make money, having a plan is crucial if you want to be consistently successful and survive in the trading game.

If you have a written trading or investment plan, congratulations! You are in the minority. While it is still no absolute guarantee of success, you have eliminated one major roadblock. If your plan uses flawed techniques or lacks preparation, your success won't come immediately, but at least you are in a position to chart and modify your course. By documenting the process, you learn what works and how to avoid repeating costly mistakes.

Whether or not you have a plan now, here are some ideas to help with the process.

Disaster Avoidance 101

Trading is a business, so you have to treat it as such if you want to succeed. Reading some books, buying a charting program, opening a brokerage account and starting to trade is not a business plan - it is a recipe for disaster. (For more, see Investing 101.)

Once a trader knows where the market has the potential to pause or reverse, they must then determine which one it will be and act accordingly. A plan should be written in stone while you are trading, but subject to re-evaluation once the market has closed. It changes with market conditions and adjusts as the trader's skill level improves. Each trader should write their own plan, taking into account personal trading styles and goals. Using someone else's plan does not reflect your trading characteristics.

Building the Perfect Master Plan

What are the components of a good trading plan? Here are 10 essentials that every plan should include:

1. Skill Assessment

Are you ready to trade? Have you tested your system by paper trading it, and do you have confidence that it works? Can you follow your signals without hesitation? Trading in the markets is a battle of give and take. The real pros are prepared and they take their profits from the rest of the crowd who, lacking a plan, give their money away through costly mistakes.

2. Mental Preparation

How do you feel? Did you get a good night's sleep? Do you feel up to the challenge ahead? If you are not emotionally and psychologically ready to do battle in the markets, it is better to take the day off – otherwise, you risk losing your shirt. This is guaranteed to happen if you are angry, preoccupied or otherwise distracted from the task at hand. Many traders have a market mantra they repeat before the day begins to get them ready. Create one that puts you in the trading zone. Additionally, your trading area should be free of distractions. Remember, this is a business, and distractions can be costly.

3. Set Risk Level

How much of your portfolio should you risk on any one trade? This will depend on your trading style and risk tolerance. It can range anywhere from around 1% to as much as 5% of your portfolio on a given trading day. That means if you lose that amount at any point in the day, you get out and stay out. It's better to keep powder dry to fight another day if things aren't going your way. (For more, read "What Is Your Risk Tolerance?")

4. Set Goals

Before you enter a trade, set realistic profit targets and risk/reward ratios. What is the minimum risk/reward you will accept? Many traders will not take a trade unless the potential profit is at least three times greater than the risk. For example, if your stop loss is a dollar loss per share, your goal should be a $3 profit. Set weekly, monthly and annual profit goals in dollars or as a percentage of your portfolio, and re-assess them regularly. (For more, see "Calculating Risk and Reward.")

5. Do Your Homework

Before the market opens, check what is going on around the world? Are overseas markets up or down? Are index futures such as the S&P 500 or Nasdaq 100 exchange-traded funds up or down in pre-market? Index futures are a good way of gauging market mood before the market opens.

What economic or earnings data is due out and when? Post a list on the wall in front of you and decide whether you want to trade ahead of an important report. For most traders, it is better to wait until the report is released than take unnecessary risk. Pros trade based on probabilities. They don't gamble.

6. Trade Preparation

Whatever trading system and program you use, label major and minor support and resistance levels, set alerts for entry and exit signals and make sure all signals can be easily seen or detected with a clear visual or auditory signal.

7. Set Exit Rules

Most traders make the mistake of concentrating 90% or more of their efforts in looking for buy signals, but pay very little attention to when and where to exit. Many traders cannot sell if they are down because they don't want to take a loss. Get over it or you will not make it as a trader. If your stop gets hit, it means you were wrong. Don't take it personally. Professional traders lose more trades than they win, but by managing money and limiting losses, they still end up making profits.

Before you enter a trade, you should know where your exits are. There are at least two for every trade. First, what is your stop loss if the trade goes against you? It must be written down. Mental stops don't count. Second, each trade should have a profit target. Once you get there, sell a portion of your position and you can move your stop loss on the rest of your position to breakeven if you wish. As discussed above, never risk more than a set percentage of your portfolio on any trade.

8. Set Entry Rules

This comes after the tips for exit rules for a reason: Exits are far more important than entries. A typical entry rule could be worded like this: "If signal A fires and there is a minimum target at least three times as great as my stop loss and we are at support, then buy X contracts or shares here."

Your system should be complicated enough to be effective, but simple enough to facilitate snap decisions. If you have 20 conditions that must be met and many are subjective, you will find it difficult if not impossible to actually make trades. Computers often make better traders than people, which may explain why nearly 50% of all trades that now occur on the New York Stock Exchange are computer-program generated.

Computers don't have to think or feel good to make a trade. If conditions are met, they enter. When the trade goes the wrong way or hits a profit target, they exit. They don't get angry at the market or feel invincible after making a few good trades. Each decision is based on probabilities. (For more, read: "The NYSE and Nasdaq: How They Work.")

9. Keep Excellent Records

All good traders are also good record keepers. If they win a trade, they want to know exactly why and how. More importantly, they want to know the same when they lose, so they don't repeat unnecessary mistakes. Write down details such as targets, the entry and exit of each trade, the time, support and resistance levels, daily opening range, market open and close for the day, and record comments about why you made the trade and lessons learned.

Also, you should save your trading records so that you can go back and analyze the profit or loss for a particular system, drawdowns (which are amounts lost per trade using a trading system), average time per trade (which is necessary to calculate trade efficiency) and other important factors, and also compare them to a buy-and-hold strategy. Remember, this is a business and you are the accountant.

10. Perform a Post-Mortem

After each trading day, adding up the profit or loss is secondary to knowing the why and how. Write down your conclusions in your trading journal so you can reference them later.

The Bottom Line

Successful paper trading does not guarantee you will have success when you begin trading real money and emotions come into play. But successful paper trading does give the trader confidence the system they are going to use actually works. Deciding on a system is less important than gaining enough skill to make trades without second guessing or doubting the decision.

There is no way to guarantee a trade will make money. The trader's chances are based on their skill and system of winning and losing. There is no such thing as winning without losing. Professional traders know before they enter a trade that the odds are in their favor or they wouldn't be there. By letting their profits ride and cutting losses short, a trader may lose some battles, but they will win the war. Most traders and investors do the opposite, which is why they never make money.

Traders who win consistently treat trading as a business. While it's not a guarantee that you will make money, having a plan is crucial if you want to be consistently successful and survive in the trading game.

Monday, August 20, 2018

EURUSD DAILY CHART ANALYSIS (20 AUG 2018 @ 23:07)

USD is still going strong in the market. EUR having no strong economic report or event to be held this week is expected to continue its struggle to gain momentum against USD whereas any positive outcome of the USD events is expected to help regain momentum in the coming days.

SUPPORT: 1.1300, 1.1150

RESISTANCE: 1.15, 1.17

BIAS: BEARISH

MOMENTUM: VOLATILE

SUPPORT: 1.1300, 1.1150

RESISTANCE: 1.15, 1.17

BIAS: BEARISH

MOMENTUM: VOLATILE

Monday, July 23, 2018

EURUSD DAILY ANALYSIS

FUNDAMENTAL ANALYSIS & TECHNICAL ANALYSIS

AUD/USD has been quite corrective and volatile between the price range of 0.73 to 0.75 area which is still expected to push lower in the coming days as of the trend momentum. AUD has been quite positive with the recent gains against USD which is expected to last for short-term.

Ahead of the high impact economic reports to be published on Thursday this week including CPI report which is expected to show an increase to 0.5% from the previous value of 0.4% and Trimmed Mean CPI report is expected to be unchanged at 0.5%. Today AUD CB Leading Index report is going to be published which previously was at 0.1% and expected to have an optimistic outcome.

On the other hand, this week Core Durable Goods report is going to be published on Thursday which is expected to increase to 0.5% from the previous value of 0.0% and Average GDP report on Friday is expected to increase to 4.0% from the previous value of 2.0. Today Existing Home Sales report is going to be published which is expected to have a slight increase to 5.46M from the previous figure of 5.43M.

As of the current scenario, both currencies in this pair are quite optimistic with the upcoming economic reports which might lead to further volatility in the pair but USD may have an upper hand over AUD having bigger gap in the forecasts with more optimism in the market sentiment.

Sunday, July 1, 2018

FOREX - WEEKLY OUTLOOK: JULY 2 - 6 (INVESTING.COM)

Investing.com - This week investors will get the chance to parse through the minutes of the Federal Reserve’s June meeting on Thursday, after they return from Wednesday’s Independence Day holiday.

The Fed hiked interest rates in June and signaled for the first time that they could lift rates four times this year so market watchers will be focusing on the discussions around the inflation outlook and trade war fears.

On Friday, attention will shift to the U.S. employment report for June for an update on the health of the labor market. The report is expected to show that hiring cooled.

Last month’s jobs report was overshadowed by a tweet from U.S. President Donald Trump that said he was looking forward to the data, so investors will likely keep an eye on the president’s Twitter account ahead of the release of the report.

Alongside the jobs report, markets will watch for updates on the U.S. manufacturing and services sectors.

The dollar fell sharply against the euro on Friday as political uncertainty in Europe eased after European Union leaders reached a deal on migration, easing pressure on German Chancellor Angela Merkel.

EUR/USD rose 1% to 1.1684 late Friday.

The gains in the euro pressured the dollar broadly lower. The U.S. dollar index, which measures the greenback’s strength against a basket of six major currencies, was down 0.81% at 94.23 late Friday.

Gains in the pound also pressured the dollar. GBP/USD climbed 1.02% to 1.3210 after an upward revision to UK first quarter growth revived hopes for monetary policy tightening in the coming months.

The greenback fell to two-week lows against its Canadian counterpart, with USD/CADdropping 0.87% to 1.3133 in late trade.

The gains in the loonie came after data showing an unexpected uptick in Canadian economic growth in April potentially set stage for a Bank of Canada rate hike as soon as this month.

Despite Friday’s losses, the dollar index finished the second quarter with gains of 5.6% on the back of the divergence in monetary policy between the Fed and other central banks.

Ahead of the coming week, Investing.com has compiled a list of significant events likely to affect the markets.

Monday, July 2

China is to release data on the Caixin manufacturing index.

The UK is to release data on manufacturing activity.

Financial markets in Canada will be closed for a holiday.

In the U.S., the Institute of Supply Management is to publish its manufacturing index.

Tuesday, July 3

New Zealand is to release data on business confidence.

Australia is to report on building approvals and the Reserve Bank of Australia is to announce its benchmark interest rate and publish a rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

The UK is to release data on construction activity.

Wednesday, July 4

Australia is to produce data on retail sales and trade.

China is to release data on the Caixin services index.

The UK is to release data on service sector activity.

Financial markets in the U.S. will be closed for a holiday.

Thursday, July 5

Bank of England Governor Mark Carney is to speak.

The U.S. is to release the ADP nonfarm payrolls report as well as the weekly report on initial jobless claims and the ISM is to publish its non-manufacturing index.

Later in the day, the Federal Reserve is to publish the minutes of its June meeting.

Friday, June 6

The UK is to publish an industry report on house price inflation.

Canada is to publish its latest employment report.

The U.S. is to round up the week with the nonfarm payrolls report for June.

Wednesday, June 27, 2018

SOUTH AFRICA'S RAND WEAKENS AS DOLLAR RISES, STOCKS RECOVER (REUTERS ARTICLE)

JOHANNESBURG, June 27 (Reuters) - South Africa's rand fell against the dollar on Wednesday as the greenback rose broadly after trade-related worries eased amid a slight softening of the U.S. administration's approach to Chinese investment. FRX/

At 1526 GMT, the rand ZAR=D3 traded at 13.8100 per dollar, 1.96 percent weaker than its close on Tuesday.

U.S. President Donald Trump said on Wednesday he would use a strengthened security review process to deal with threats from Chinese investments to acquire U.S. technologies, instead of imposing China-specific restrictions. yield on the benchmark government bond due in 2026 ZAR186= rose two basis points to 8.9 percent. The yield had risen to 9.24 percent last week, its highest since December.

Rand Merchant Bank fixed income analyst Gordon Kerr said local bonds held up well despite the risk-off environment.

"It remains to be seen if we can push lower from here. Investors don't seem to be in a real rush to buy. But that will change if USD/ZAR manages to break through 13.10," Kerr said in a note. "Given how bid the dollar is at the moment, it does seem like the market still favours the top side."

Data from the Johannesburg Stock Exchange showed foreign investors sold 34.7 billion rand ($2.5 billion) worth of South African bonds between January and June, the highest sell-off on record. the bourse, stocks lifted after two consecutive negative sessions led by bourse heavy-weight and rand-hedge Naspers.

The benchmark Top 40 index .JTOPI was up 0.39 percent to 49,329 points, while the all share index .JALSH was up to 0.21 percent to 55,369 points.

"The all-share was down 1.5 percent and now we see the market up ...predominately driven by Naspers," said Grant Gilbert, portfolio manager at Nedbank Private Wealth.

Naspers NPNJn.J , which owns about 30 percent of the Chinese technology firm Tencent, closed up 2.57 percent to 3177.99 rand.

Rand-hedged stocks, which make the bulk of their revenue outside South Africa and tend to strengthen as the currency weakens.

($1 = 13.7130 rand)

USDCHF DAILY ANALYSIS (27 JUNE 2018)

Looks like the Greenback is gaining ground against Swissy and it is trading near its daily highs. The momentum is quite bullish at the moment and we might see war between bulls and bears at 0.9950 level and if bulls win the war the price will be pushed to 1.00552 level where there is strong resistance.

Tuesday, June 26, 2018

BULLISH BAT ON NZDUSD DAILY (26 JUNE 2018)

NZD/USD is currently testing the 0.6854 level, the May 16 low (the former 2018 low). Bulls will look for long position from the level.

Subscribe to:

Comments (Atom)